| Retirement Software Life/Annuity Software Order Customers News About Support Downloads |

RMD Software Frequently Asked Questions |

| Question: | Where do I find answers to technical questions about RMD? | |

| Answer: |

One of the best sources of information is the IRS website.

Another good source is an article written by Elaine Floyd, CFP titled

28 Rules on IRA Distributions. We also like the book Distributions from Qualified Plans, 3rd Edition, by Thomas F. Streiff and David Shapiro

published through Dearborn Press.

|

|

| Question: | Why do I need a Required Minimum Distribution calculator? | |

| Answer: |

The RMD calculator is a wonderful door opener for retired customers and will give you a tremendous

service opportunity. The RMD Calculator may help your customers avoid severe IRS

penalties, and will give them the information they need to make

their retirement funds last as long as possible. The RMD gives the

customer a valid reason for giving the financial advisor the details of

all his/her qualified retirement plans and a deadline for an annual

review.

|

|

| Question: | My firm has five associates but would like to have support personnel perform the RMD Calculations. Each associate would like to have access to the data stored in a central database on our network. Is this possible? | |

| Answer: |

Yes. After you purchase a five-user license, your network administrator should

email

ImagiSOFT's support team for instructions on how to configure the RMD Software to

store the data in a central database on your network.

|

|

| Question: | How do I backup my database of saved illustrations? | |

| Answer: |

There are two ways to backup the

RMD Calculator database. You can backup the database on

a floppy disk or on the Internet. To backup the

database using a floppy, go to Options + Backup Database to

Floppy. Insert a 3½ diskette into your C drive and

backup the database. To backup using the Internet, go

to Options + Backup Database to Internet. You

will need to enter a unique description code and be connected

to the Internet to backup and retrieve your database via the

Internet.

|

|

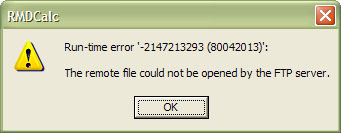

| Question: |

My software gives me the following error message after I perform the Help | Software Updates function:

How can I update my software? |

|

| Answer: |

The problem is very likely that RMDCalc.exe is being blocked by your firewall.

You will have to configure your firewall to allow our software to connect to the Internet.

It may be easier, however, to re-install the software by clicking the "Downloads" link on

the top corner of this page.

|

|

| Question: | Are distributions from a Roth IRA subject to RMD rules? | |

| Answer: |

No. The RMD rules do not apply to

Roth IRAs owned by living participants. However, after the

participant dies, the beneficiary must withdraw the RMD from his or her

inherited Roth IRA account. Use the Beneficiary Required Distribution

calculator each year for these calculations.

|

|

| Question: | Under the old RMD rules, any election I make is irrevocable. Is this true with the new rules? | |

| Answer: |

No. The IRS believed this was unreasonably restrictive since the participant's financial circumstances could change

future years. Participants are no longer required

to designate a beneficiary or decide in advance whether or not to

recalculate their life expectancy.

|

|

| Question: | When does the planholder have to start to take the Required Minimum Distributions from his or her plan? | |

| Answer: |

The Required Beginning Date (RBD),

is the date on which the plan participant

must begin taking his/her RMD. The RBD for Non-IRA

accounts is the later of the year in which the participant

retires or in which he/she turns 70½. The RBD for

traditional IRA accounts is age 70½ regardless of when the

participant retires. The RMD software incorporates all these

rules and calculates the RBD for you.

Remember, no matter what type of plan, the planholder can wait until April 1st of the year after their RBD to withdraw the RMD. However, if they wait to take their first distribution until the following year, they will also have to take a second distribution by December 31st of that same year. Since all distributions are taxed as regular income, this could put them in a higher bracket resulting in higher taxes. Representatives should consult with the planholder's income tax advisor when helping the planholder decide when to take his or her first distribution. |

|

| Question: | My customer has more than one retirement plan. How do I calculate the RMD for each one? | |

| Answer: |

The RMD Calculator is designed to

illustrate and calculate one IRA, pension, or retirement plan at

a time. If your client has multiple accounts, you must

make a separate illustration for each account. This means

the client may have several saved illustrations, one for each

account for each year.

To comply with IRS regulations, an individual RMD must be calculated for each IRA, pension or retirement plan, each year after the Required Beginning Date. After an individual RMD has been calculated for each account, you may combine similar accounts and take the distributions from a single account or combination of accounts (all IRAs, all 403(b)s, etc.). However, you cannot combine dissimilar account types and take the distribution from a single source. If you have both a 401(k) and an IRA account, you must calculate the RMD separately and take a distributions from each plan type. |

|

| Question: | I want to e-mail the report to my customer. Can I do this? If so, how? | |

| Answer: |

To send your

customer his or her RMD report via e-mail, export the report to a PDF file.

You will find this option in the File +

Export Report to PDF pull-down menu. A window will appear

that tells you the report has been successfully exported to a

PDF file, followed by the file folder and name of the

file. Simply attach this file to an e-mail and send it to your

customer.

|